Capitalize Vs Expense Price Accounting Rules + Examples

This technique provides a extra complete view of a company’s monetary efficiency over a interval. Non-Operating Bills are prices not directly associated to a company’s primary enterprise actions. These include interest expense on loans, losses from the sale of belongings, stock write-offs, or one-time legal settlements. Interest paid on a enterprise loan is a non-operating expense as a end result of it arises from financing activities rather than the core operations of selling items or companies. Separating these from operating expenses helps stakeholders understand the true efficiency of the core business.

How Expenses Match Into Monetary Statements

Staying on top of your bills and enterprise budget additionally helps you determine issues like overspending and money circulate points early on – so you can nip them within the bud before they turn into greater issues. On high of that, monitoring bills helps you persist with expense definition in accounting a price range, which is crucial for any small enterprise owner. By setting a price range for specific periods or projects, you can make sure you’re allocating your resources where your business wants them. Monitoring your expenses is important to staying on top of your business finances and your profitability. One of GAAP’s primary objectives is to match income with bills, so recording the entire Capex directly would skew monetary results and result in inconsistencies.

- For example, in case your items are sold in February, then the related cost of products sold in addition to income will get recorded in the identical month.

- In order to assist you advance your career, CFI has compiled many sources to help you along the path.

- For instance, a company utilizing the cash foundation of accounting receives an electricity invoice in March for its electricity usage in February, and pays the bill on March 15.

- Some widespread examples of costs are employee salaries, promoting, rent, utilities, taxes, and supplies.

Utilities Expense Beneath The Accrual Foundation Of Accounting

However, if you have questions about what’s deductible, it’s sometimes a good idea to consult with a tax professional. Yes, a wage is taken into account an expense and is reported as such on a company’s income assertion. Business house owners aren’t allowed to say their private, nonbusiness expenses as enterprise deductions. For instance, ABC International receives a water bill from the native water company that covers the interval from the twenty sixth day of the previous month to the twenty fifth day of the current https://www.kelleysbookkeeping.com/ month, in the amount of $2,000. A crucial part to accrued bills is reversing entries, journal entries that back out a transaction in a subsequent period. Accruing bills will increase each unpaid bills and liability accounts for a company.

Expenses In Accounting

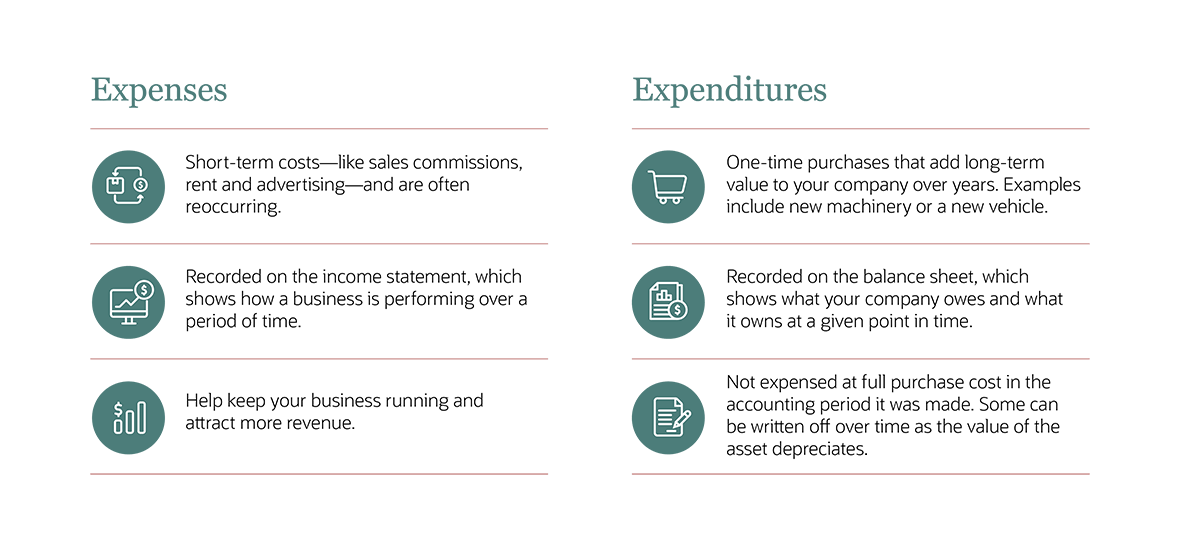

The main reason for using expense accounts is to assist expense categorization. The IRS has a schedule that dictates the portion of a capital asset a enterprise might write off each year till the entire expense is claimed. The number of years over which a enterprise writes off a capital expense varies based mostly on the kind of asset. Capital expenditures, commonly known asCapEx, are funds used by a company to acquire, upgrade, and maintain bodily assets such as property, buildings, an industrial plant, expertise, or equipment.

Tools like Monetary Cents additionally assist your group keep on top of shopper work and ensure nothing slips through the cracks during month-end close. Bills seem on both the revenue statement and the balance sheet, but in numerous methods. Understanding their position in every report is important for producing accurate financials and advising shoppers with confidence. When the business later settles the invoice, you debit Accounts Payable (to cut back the liability) and credit Money (to scale back the asset). The expense itself stays within the interval it was incurred, not the period it was paid, making use of the matching precept launched earlier. However if they’re not correctly categorized or supported with documentation, your client might miss out on deductions or increase red flags throughout an audit.

Since there is not any unique identifier on the invoice, an organization has no way of telling if it has already paid the invoice. This downside can be prevented by using various methodologies to derive an invoice quantity, corresponding to using the date vary of an invoice as its invoice quantity. If a price is capitalized as an alternative of expensed, the company will show both a rise in belongings and equity — all else being equal. Gadgets which might be expensed, corresponding to inventory and worker wages, are most frequently associated to the company’s day-to-day operations (and thus, used quickly). These can differ by jurisdiction, however most international locations require that companies hold authentic receipts or invoices and proof of fee for between 3-7 years (7 years within the US). These detailed records should also include the date, amount, and business objective of the expense.